gdp"programmatic is not a bet. It is the estimate to the effect that the maneuver produces the product". As the minister of the Economy, Pier Carlo Padoan, in a hearing in Parliament on the update Note to the Document of economy and finance, responded to rejection arrived on Monday fromOffice of the parliamentary budget< / b> pads, bank of Italy and Court of Auditors. "The government confirmation its programmatic framework for the 2017, with growth to 1%," said the owner of the Treasure". The estimate "is optimistic according to some, ambitious according to others, but viable. Also we consider that this objective is ambitious because we have the duty to be. This ambition is supported by a maneuver that gives a boost, a boost to growth," for now "slower than desirable" because of "the slowdown of the global economy and the european together with the'insufficient action of reform of the Italian economy in the years preceding the crisis".

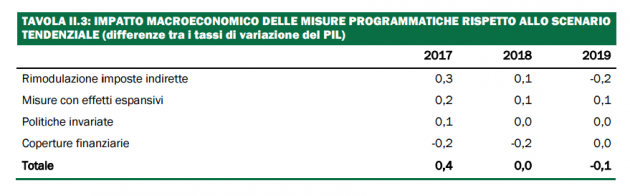

The Office in charge of monitoring independent on public accounts and the Palazzo Koch have shown that appears to be too optimistic, the deviation of 0.4% between the growth trend – the policies, estimated to be in the a +0,6% – and the increase of gdp in the program, that is, the one that according to the government, Italy will score, thanks to the stimulus that will be entered in the Budget, expected by the end of next week. According to the Note, the programmatic will fly precisely at the +1 percent. This is thanks, summarized Padoan, the "two axes" around which will be built in the Budget law: the sterilization safeguard clause (those that provide for the automatic increase of Vat to recover 15 billion), according to the executive, will push the gdp even 0,3%, and the "re-launching growth". Of course along with the "effort to reforms," but "need time to unfold their full effect." Among the "additional measures to support growth" that will be included in the maneuver, Padoan has listed "the investment incentives toinnovation, research and development, support to small and medium-sized enterprises, the major government investment initiatives family support and pensions low".

Multipliers high, but may be underestimated" – "multipliers", that is, precisely, the estimated impact of the maneuver, "are higher, especially in a phase of interest rates zero, and the proximity of deflation. But they are not overestimated, we are very confident that in case they are underestimated, then there may be positive surprises, as it is said in jargon". "The maneuver, ” he added, Padoan – is built with the care often relied on by the president of the Ecb, and that yesterday was called during the hearing of the Bank of Italy".

The confirmation of the estimates in spite of a disclaimer – Monday night, the chairman of the Budget committee of the Chamber, Francesco Boccia, he stressed that in the updated note of the government has failed the provisions of Budget reform which provides that in the document are inserted in the "signs of the main areas of intervention of the maneuvering and a brief description of the financial effects", with the result that "we do not not take note" of the not validated of the Upb, "and ask for a physiological slip of the terms in respect to the times that we had the data, because you will need to be affected by the Upb after the choices that will be taken in the next two weeks". The law 243 of 2012, which established the office states in effect that "if the Office express-ratings significantly divergent compared to those of the government, on the request of at least a third of the members of a Commission parliamentary jurisdiction in matters of public finance, the latter explains the reasons for which it considers of confirm their own evaluations or believes to comply to those of the Office". But when the leader of Forza Italia in the Chamber Renato Brunetta asked that, “given the lack of information and the opinion contrary of the Upb, Padoan come back tomorrow in the Commission, with the integrations and the appropriate depth within the meaning of article 18 of the law 243,” the minister replied confirming the predictions.

"Firm intention to continue with privatisation". Despite the flops – On the front of the debt, which this year increases to 132,8% of gdp and in 2017 is expected in the fall in the slightest (132,5) more to the effect of, precisely, "optimistic" forecast of growth of the product, Padoan reiterated what I wrote in the introduction to the Note: "To reduce it remains the stop the intention of the government to continue with the program real estate sales and privatisation, curbed this year by the conditions of high market volatility". Sin that the same document attesting to the fact that the proceeds from the sale of shares of public companies are stopping this year at the 0.1% of gdp (about 1.6 billion), as against 0.5% previously expected, and by the brick of the State will arrive only 750 million.