Increase in VAT frozen for three years , IRES cut 4 points without exceeding the 3% deficit limit : this is the program of the new tax cut at the Renzi government to stimulate growth. the prime minister is ready to bring the issue of a tax cut in 2017 on the board of the PES leaders, ahead of the EU Council of 17. Domestically you work for a Irpef cut already fixed for 2018 which will hopefully bring forward . To do this, you need to touch the 3% in the ratio of deficit to GDP. To study the reduction of 6 points in the tax wedge, with an impact on future pensions to be assessed.

The new cut of the Renzi government taxes

The Prime Minister is ready to bring the issue to Brussels for a coordinated intervention and not block tax cut, to be set in 2016 and be operational by next year . This will be discussed on March 12 in Paris at the PES leaders, the European Socialist Party, in view of the EU Council of 17. Meanwhile Palazzo Chigi and the Italian Ministry of Economics work plan, aiming to accelerate the tax relief (the pressure of the income tax is still high, above 43%). The Irpef cut is set for 2018 but could be brought forward to 2017. As cover everything? Valentina Count of Republic tells us that spending is obviously in deficit :

Meanwhile, a flexibility in the accounts which allows , for example, touch the 3% in the ratio of deficit to GDP in 2017, now estimated at 1.1%. Each additional decimal place is worth a billion and 600 million. So get by assumption to 2.9% means freeing as many as 29 billion. “Now it is early to say,” Morando brakes. But “it is already decided that from January 1 of 2017 triggered a reduction of four points the IRES”, the corporate tax. Unlikely that this cut “will be brought forward to 2016″. At the moment, therefore, it remains the cut IRES next year and the personal income tax in 2018, as per schedule. But it does not rule out anything, even merge the two measures would be very expensive. Especially if we consider the 15 billion potential increases in VAT has always ward for 2017 (the safeguard clause). That’s why the government thinks well on reducing the tax wedge on labor and on the company.

the idea of the contribution wedge reduction (La Repubblica, February 29, 2016)

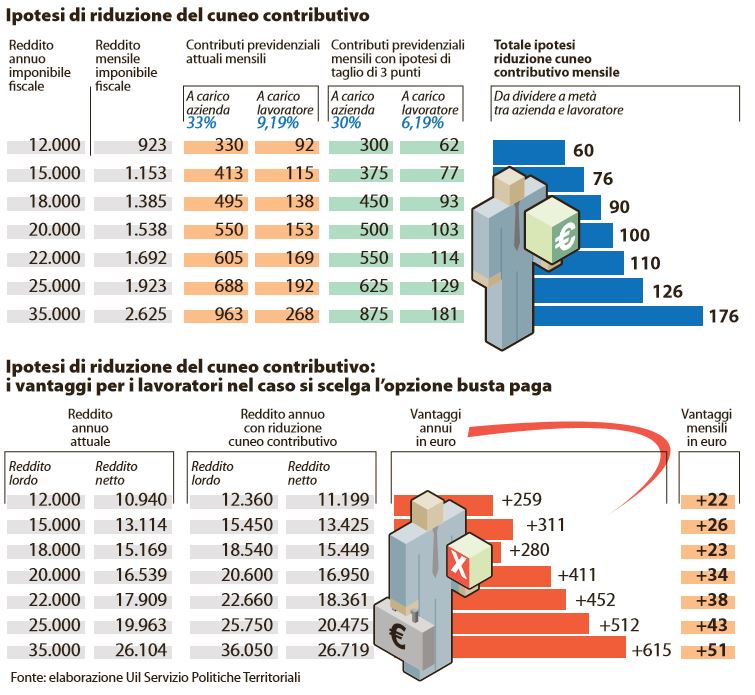

another plan, always explains the newspaper of Calabresi, is instead cut into six points the wedge of new hires, three dependent points of employer and three employee forever. There are two ways to implement it: through the personal income tax, lower rates; or by cutting social security contributions, ie provisions for retirement . The cut worth 125 Euros a month and about 1500 euro per year , but in case that half is diverted to the pension funds to make up the missed social security contributions in his pocket to the worker would remain 43 euro.

the deal may be worth about 6 billion over three years (mid-2015 work bonus). But these contributions are not compensated in less INPS by the State, as it usually does to any relief at work. On the contrary, they represent a sharp cut on future pensions: less contributions, salary a little ‘richer, but poorer check in the future. That’s why the Nannicini proposal also provides for an option: the possibility for the worker to pay his three points in less than contributions to the supplementary pension, rather than land them in payroll (where among other things would be affected Irpef).

security rincarata but right from the Renzi government that brought the taxation of pension funds from 11.5% to 20%. be why, six months from the idea, now the undersecretary brakes: “It’s a challenge, but we have to figure out how to cost less than the open-ended in terms of contributions, without adversely affecting pension expectations of workers.” On the other hand the advantage pay in envelopes, for both the employer and the employee, there would be phenomenal. Nothing compared with the current generous tax relief, however, all funded from exchequer, therefore in deficit (thanks to European flexibility).

The fees and expenses

for years, the state budget is a safeguard clause, inserted to appease the EU, which provides a permanent increase in VAT. So far the government has managed to neutralize it year by year finding temporary resources. This time, the government aims to freeze rates for at least three years, from 2017 to 2019. The VAT increase would cost 15 billion a year to consumers. Mario Sensini in the Corriere della Sera interview Enrico Morando:

How to find the covers? Even depress growth cuts …

<'p> Do you plan to use savings or revenue that today can not be counted?

“Especially those to investment spending. We are aware of it and we take into account, but not give up the objective of the spending review. And there are a few new things that will help us a lot. Meanwhile, the public administration reform. It is expected that many of his decrees involve savings, which will now be finally quantified. Payments which we can use as covers of other expenses in the second or third year of implementation of each small piece of Madia reform. Then help us reform the Stability Law, which this year will also absorb the budget law.

“in order to revise the spending without doubt. The reform will allow us to enter into the budget, and then use the programming of public finance, including the savings that do not derive directly from legislative innovation, but by administrative action resulting. ” An example? “With the reduction from 3000 to 35 of the purchase of the State stations we will also quantify the savings due to greater centralization of operations.”Better the reductions in contributions or income tax?

“it would be more effective to make a structural reduction in contributions, perhaps at a lower level than that provided for only 2016 would close the maneuvers for the reduction of taxes on labor, would help both households and businesses. There may be scope to anticipate the operation to 2017, provided that the EU is consistent with itself gives Member States of the proposed flexibility. Without breaking through the roof of the 3% “

No comments:

Post a Comment