Back The spread of fever . The yield spread between BTPs and Bund has broken through share 140 basis points and stood at levels that were not affected since early July 2015. With the collapse of the stock indices around the world, driven today by Milan Stock Exchange , purchases focus on bonds of northern Europe and sales of those peripheral countries, with Italy and Spain in the lead. The yield spread between ten-year Italian benchmark (ISIN IT0005127086) and German, which was stable in the opening of sitting at 126 basis points, now stands at 146 basis points, with the yield on ten-year BTP flying to 1.68 % from 1.71% the opening.

the spread of fever

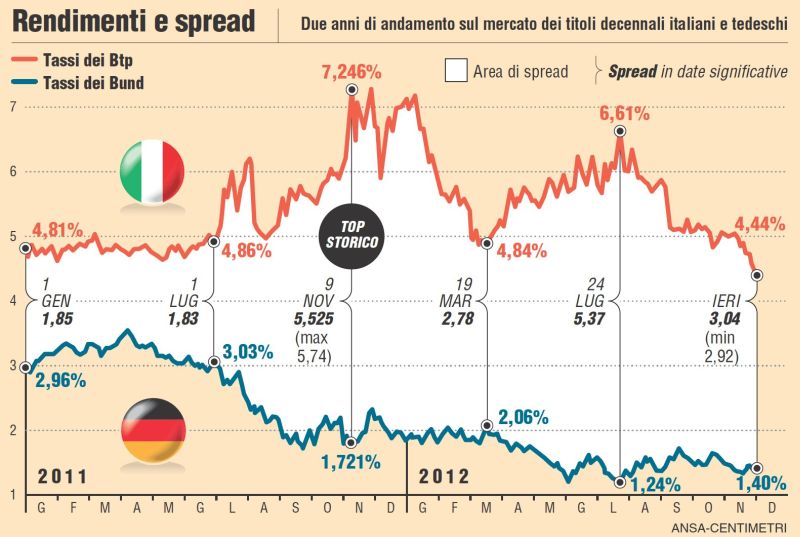

And the memory can only go back to 2011: January 4 it spread was at 173 points. Dec. 30 will arrive at an altitude of 528, an increase of 355 points. The first six months of the year with a swing spend more of the spread between BTPs and German Bund counterparts, thermometer fragile both Italian economy. The July 1 is distributed the bulletin of Standard & amp; Poor’s on the government’s maneuver Berlusconi: “There remain significant risks to the debt reduction plan, primarily because of weak growth” says the rating agency, partly recovering the concepts expressed already in May, when the ‘ Italy’s outlook was revised from “stable” to “negative”. Then the chaos continues:

On July 7, Italy is again under stress, increases the pressure on our BTP and squirts spread over portion 226, the record from birth euro. Same fate for the Spanish government bonds, Portuguese, Greek and Irish, the new weak eurozone. In Italy there are increasing rumors about keeping the government and the possible resignation of Economy Minister Giulio Tremonti, combined with concerns about the operation and the alleged non soundness of banks. E ‘in this climate that Draghi mature the idea of releasing a strong statement that the embankments landslide: 15 lines that go around the world and reassuring about the goodness of the maneuver and the credibility of the measures to achieve a balanced budget in 2014 .

Between 4 and 5 August, the spread is dangerously close to the 400 points, and in that climate the governor of the European Central Bank Mario Draghi sent a secret letter to Silvio Berlusconi which indicates deemed urgent measures to prevent the collapse of the country and the euro. The center responds by announcing an urgent economic package that was approved in September. Meanwhile, the letter was published Sept. 29 in the Corriere della Sera.

spread BTP / Bund 2011-2012 (The messenger)

in early September while the spread resumed its run because by Standard & amp; Poor’s for Italy comes the dreaded downgrade. On 23 October France and Germany launched an ultimatum to Berlusconi: “immediately implement measures for debt and growth.” And at a press conference takes place the famous scene of the laughter of the two leaders:

Meanwhile, in early November Berlusconi he understands that political tensions and war with Finian led him perilously on the threshold of the majority of the House and Senate. 12 November Silvio Berlusconi presents the Hill to resign. There she meets Mario Monti, his successor in pectore, that four days later by Giorgio Napolitano officially receive the mandate to form a new government. After the top of the historic November 9, the spread will begin a long descent back to touch too many peaks in 2012.

… like the time of Berlusconi

the difference today is very far from the top touched in those years. Yet the political situation in which it developed the tension begins to resemble . In Greece, Tsipras government is in the grip of creditors, applying for the approval of the pension reform, and the population, which has compact on strike against the cuts.

the day macroeconomic agenda focuses on industrial production in Spain where the data indicates a drop of 0.2% in December on the previous month and a rise of 3.7% on year. For the full year 2015, the figure was an increase of 3.2%. The confidence of investors in the Eurozone fell to 6 points in February from 9.6 in January, according to the SenTix index. The expectations of economists were for a level of 7.6 points. “In particular it weighs the climate in Germany and the US,” notes Sentix, adding that “the global economy is in a state of great fragility at the moment.” In the US, it looks to the index of the Fed in the labor market.

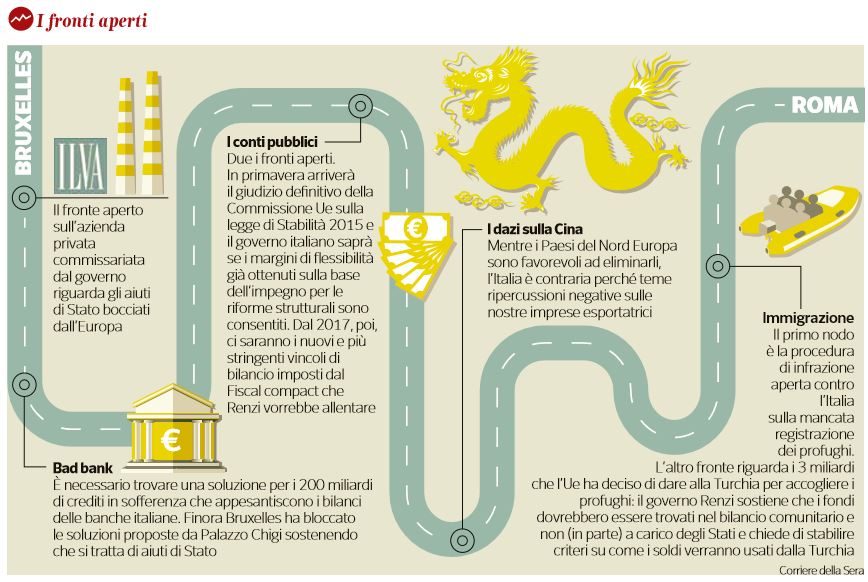

In Italy meanwhile, the difficulties of the banks for the suffering and the agreement down on bad bank add the wishes of the government on German government securities in the hands of banks and the risk of bail in even for countries seeking rescue. Added to this are all open fronts between Italy and the European Commission :

The fronts opened between Italy and EU (BBC, December 19, 2015)

Hold Operation PSE is good that Renzi begins to look back.

No comments:

Post a Comment