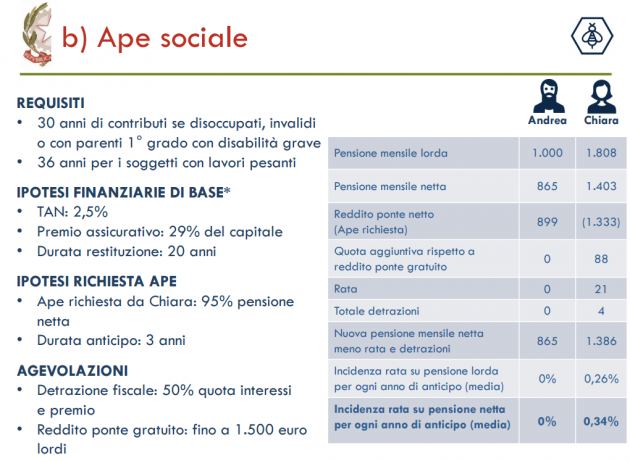

The basic example, with the table already says (almost) everything. Marco has 63 years, has paid contributions for 20, and the tip to go in the board without having the requirements of the Change (period three years) of leveraging theBee, the loan provided by the Budget. The check gross would be $ 1,000, equal to 865 euros net. Marco chooses one of the banks that have signed an agreement with l'Inps and asked to be in advance 85% of the net pension, that is 736 euro per month. When she turns 66-years-old, reaching the age of retirement required by law, begins to repay the loan and will continue to do so for the next 20 years. The installment of amortization, inclusive of interests and insurance premium, is 173 euro. Result: to get to the end of the month, until the age of 86 years, will be able to count on the 725 euros net. The calculations are of the "team statement of Palazzo Chigi" led by the under secretary Tommaso Nannicini, which had a circulation of 32 slide – with tag #of merit&need – to explain to the italians how to work the mechanism of the loan from the pension.

The incidence of the rate on the board will come up to 5,5% per annum – From the case studies are used to clarify requirements and costs emerges, first, that the "4,5-4,6%" that Nannicini has always said would be theimpact of the rata on the net pension for each year of the advance was a reference to a request equal to 85% of the board certified by the social security fund. Those who want to have a very high percentage will pay more, up to 5.5% average annual if you want to leave the job with three years and seven months in advance, compared to the age of retirement, and asking for 100% of the board certified. As if to say that the rate will move closer to 20% of the net pension. Also, you have to keep in mind, at the time of selection and calculations to access the advance, that the monthly pension of a net is provided for 13 months (and for the 13 months will be paid i n installment on the loan while the loan is granted for 12 months. The hypothesis of the basic law in the tables, is that the annual percentage rate is equal to 2.5%.

In the face of a net pension certified by Inps 1.286 euros per month for 13 months (from a total of 1.615 million) and a request for Epa to 85% of the net pension monthly for three years (1.093 euros per month), according to the calculations of the palazzo Chigi the installment once you have reached the old-age pension would be of 258 euro per month down to 208 with the tax laws. The instalment at the beginning of the return is higher (about 5.4% of the cheque), and then down with the passing of the years (4,1% at the end of the return), with the increase of the pension. From the moment you enter the old-age pension for the full 20 years to repay the loan, you would have a net pension less rate and deductions 1.078 euro per month.

Insurance compulsory, the premium of 29% of capital The slide emphasize that are provided for in benefits, in the form of a tax deduction of 50% on the interest fee and the insurance premium. The premise, in fact, is that it is compulsory to take out a policy, that serves to ensure the institute bank "in the case of premorienza". That is, if the pensioner were to pass to a better life, before you have finished paying the loan. In that case, the company pays the residual debt and any survivor is paid without deductions. The slides are based on the assumption of an insurance premium of 29% of the share capital.

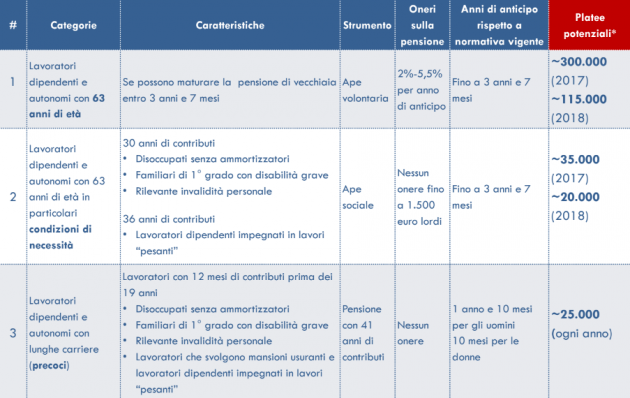

Bee social: 1,500 euro gross pay for that – The surprises are not lacking, even when you switch to theBee social, the one granted to those who "are in a condition of need" and, therefore, free of charge, so if it does load the State. In the meantime, but this was already known, in this case, it is necessary to have 30 years of contributions, if unemployed, disabled or first degree relatives who have a serious disability, and 36 years of contributions if you are carried out heavy tasks. Because most years, in this case? "The weight of the work is also related to the length of working life", is the explanation. Therefore, it is necessary to "protect those who worked the longest." And it is necessary "not to create a disparity in access with other categories of workers, deserving of protection on the basis of the type of work done."

Then, the example tables (where women are always given a pension higher than men’s, even if the data tell exactly the opposite) explain that the income bridge of free may not exceed 1,500 euros gross. Who would be entitled to a higher pension, and asks the Bee for the excess part, must pay. For example, "Clear", that has a monthly pension gross 1.808 euros, equal to 1.403 euros net, and asks the 95% coming out from work three years in advance, must pay a rate of 21 euros per month and will receive only 1.386.

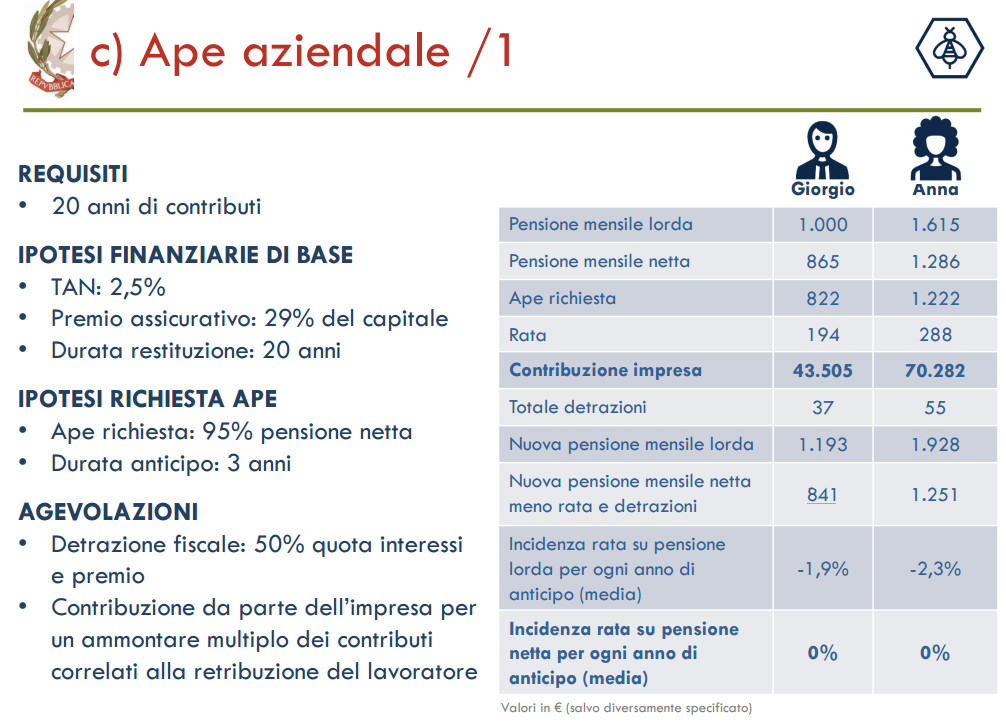

the Bee business serves the agreement with the employer – Finally,Bee company, which will access the workers are in a plan of restructuring, or find an agreement with their company. The requiremen ts are those prescribed for the Epa voluntary (63 years of age and 20 contributions), as well as the financial assumptions of the base, but the contribution will be paid by the company down payment on the future pension at the time of the age of old age. With a monthly pension gross of € 1,000, a Bee request 95% of the net pension and an advance of three years, the contribution of the company amounts to 43.505 euro:. The contribution of salt to 70.283 euro in the case of gross pension to 1.615 euros net 1.286 euro.

the Bee business serves the agreement with the employer – Finally,Bee company, which will access the workers are in a plan of restructuring, or find an agreement with their company. The requiremen ts are those prescribed for the Epa voluntary (63 years of age and 20 contributions), as well as the financial assumptions of the base, but the contribution will be paid by the company down payment on the future pension at the time of the age of old age. With a monthly pension gross of € 1,000, a Bee request 95% of the net pension and an advance of three years, the contribution of the company amounts to 43.505 euro:. The contribution of salt to 70.283 euro in the case of gross pension to 1.615 euros net 1.286 euro.